The PAN (Permanent Account Number) card application form is the essential document required to apply for a PAN card. Depending on the applicant’s status, the form can be filled out either online or offline. Below, we break down the PAN card application form, its sections, and how to fill it accurately.

Types of PAN Card Application Forms

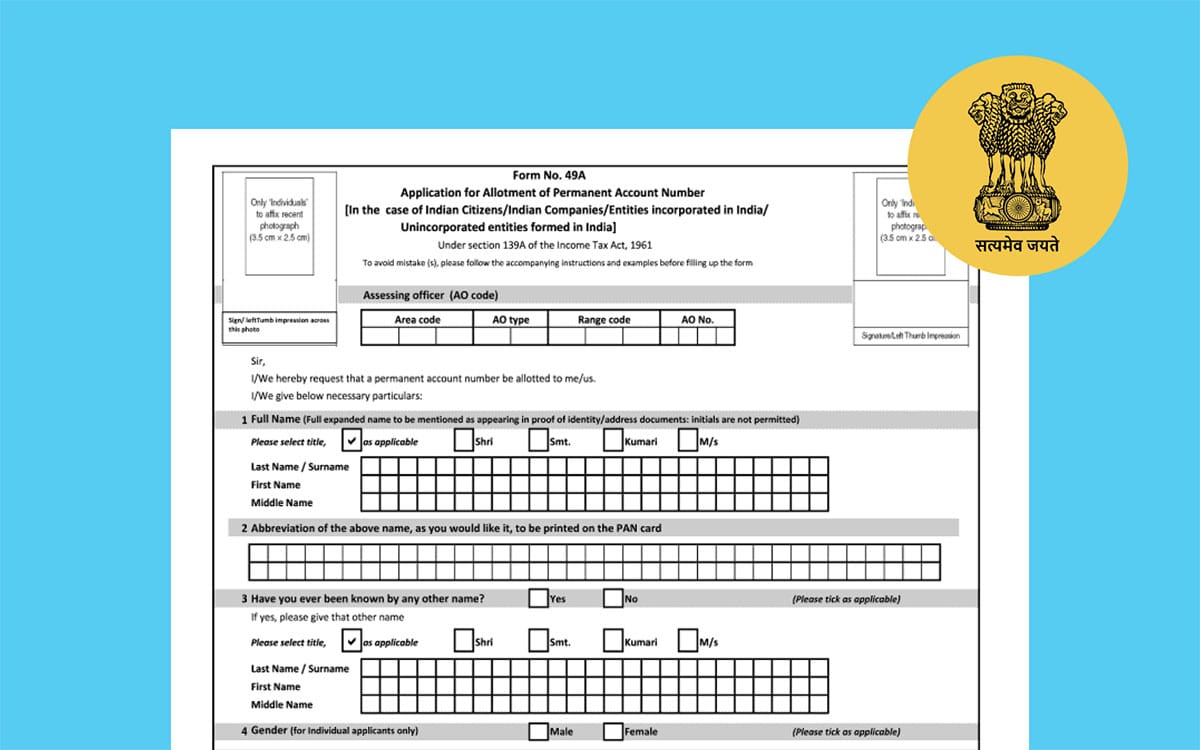

- Form 49A:

- For Indian citizens (residents and non-residents).

- Used by individuals, companies, trusts, and other legal entities based in India.

- Form 49AA:

- For foreign citizens/entities.

- Used by individuals and entities not residing in India.

Key Sections of the PAN Card Application Form

The PAN card application form is divided into multiple sections to capture all relevant details. Here’s how to complete it step-by-step:

1. Assessing the Form Type

- Select New PAN Application if applying for the first time.

- Choose Correction/Update if you already have a PAN and want to update your details.

2. Personal Details

- Full Name: Enter your full name (first name, middle name, and last name) as per your identity proof.

- Abbreviation: Provide an abbreviated version of your name for the PAN card.

- Gender: Tick the appropriate option (Male/Female/Other).

- Date of Birth: For individuals, mention DOB; for companies, trusts, or entities, provide the date of incorporation.

3. Father’s Name

- Enter your father’s name in full, even if you are married (mandatory for all applicants).

4. Contact Details

- Address:

- Residence Address: For individuals applying for personal use.

- Office Address: For businesses, trusts, or organizations.

- Mobile Number and Email ID:

- Provide an active mobile number and email ID for OTP verification and communication.

5. Citizenship Details

- For Indian citizens, select Indian.

- Foreign nationals must choose Foreign and provide country of citizenship.

6. Aadhaar Details

- Enter your 12-digit Aadhaar number if you have one (mandatory for Indian residents).

- Ensure your Aadhaar details match your PAN application.

7. Income Source

- Select your primary source of income:

- Salary

- Business/Profession

- House Property

- Capital Gains

- Income from Other Sources

- No Income

8. Representative Assessee

- Provide details of a representative, such as a guardian, manager, or parent, if applicable.

- This is usually required for minors or entities unable to represent themselves.

9. Documents Submitted

- Tick the appropriate boxes for the type of proof submitted:

- Identity Proof: Aadhaar card, passport, voter ID.

- Address Proof: Utility bill, bank statement, or Aadhaar.

- Date of Birth Proof: Birth certificate or matriculation certificate.

10. Declaration

- Sign or provide a digital signature in the declaration section, confirming all information is correct.

- Include the date and place of signing.

How to Fill the Form Online

- Visit the Official Portal:

- NSDL e-Gov (https://www.onlineservices.nsdl.com/).

- UTIITSL (https://www.utiitsl.com/).

- Select the Form Type:

- Choose Form 49A or Form 49AA based on your citizenship.

- Complete the Form:

- Fill in all required fields, upload the scanned copies of documents, and pay the application fee.

- Review and Submit:

- Double-check for any errors and click Submit.

- Acknowledge Receipt:

- Save the 15-digit acknowledgment number for tracking your application.

Common Errors to Avoid When Filling Out the Form

- Mismatch of Name: Ensure your name matches across all ID proofs and documents.

- Incomplete Address: Provide a complete and valid address to avoid delivery issues.

- Wrong Income Source: Select the correct income category to prevent future complications.

Conclusion

The PAN card application form might seem complex, but with attention to detail and accuracy, it’s easy to fill out. Whether you’re applying online or offline, ensure all sections are completed correctly and supported by valid documents. A well-prepared form speeds up the approval process and ensures you receive your PAN card without unnecessary delays.