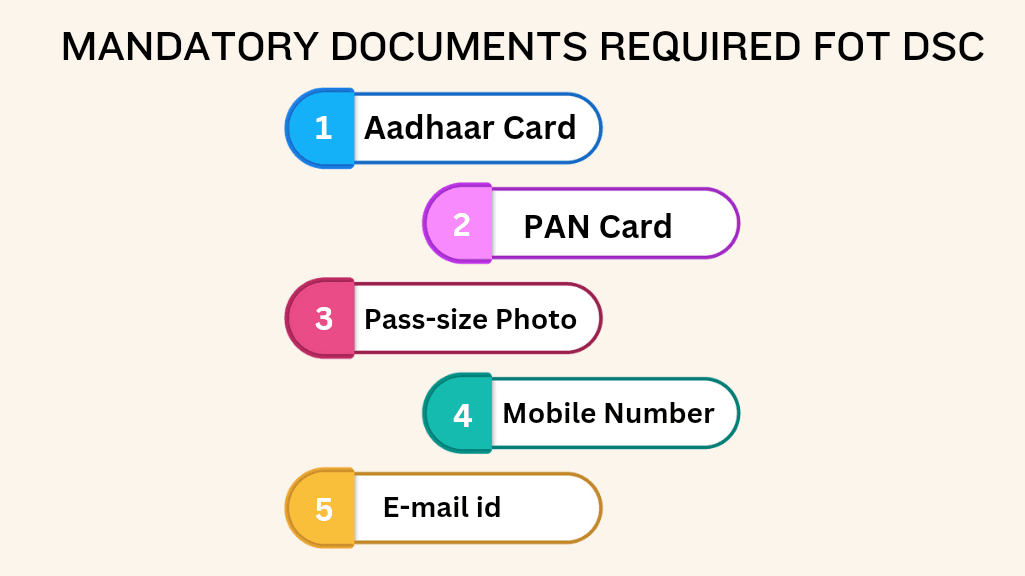

Documents for Individual Applicants

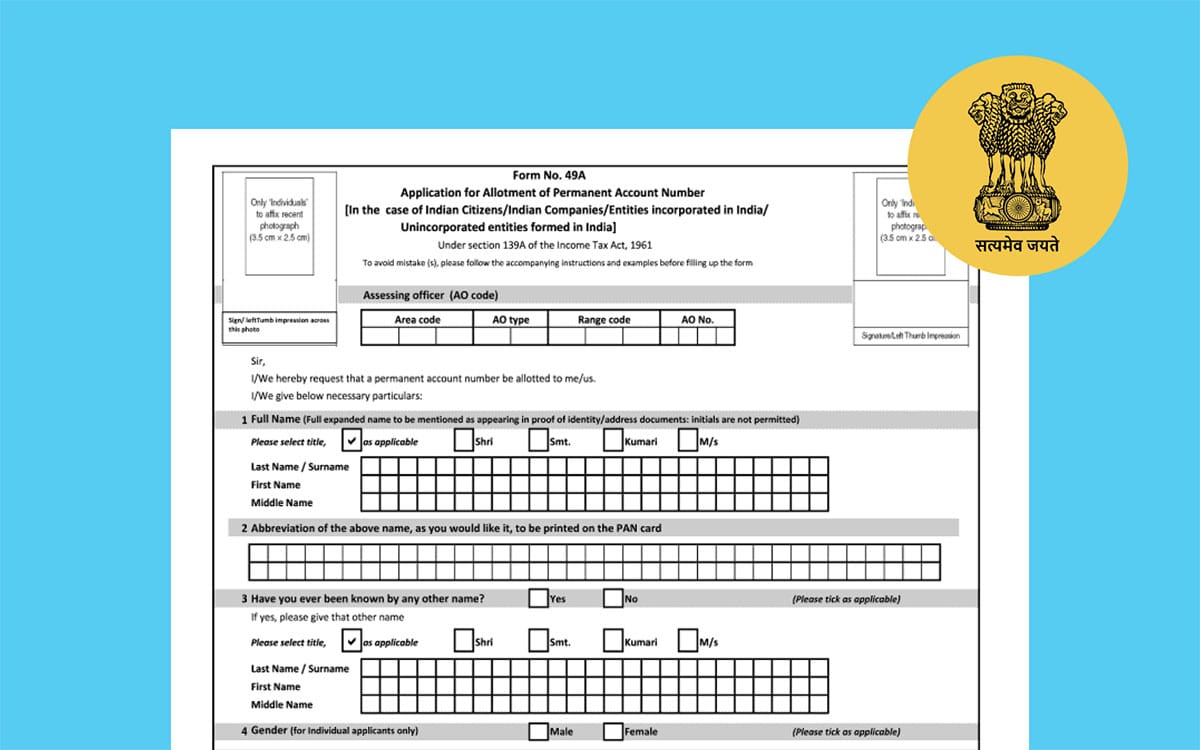

Proof of Identity (Any one of the following): Aadhaar card Voter ID card Passport Driving license Ration card with photograph Photo identity card issued by the Central or State Government Arm’s license Proof of Address (Any one of the following): Aadhaar card Utility bill (electricity, water, or gas) not older than three months Bank account … Read more